Payment Methods Every Small Business & Notary Should Consider

Getting paid is one of the most important parts of running your business. Whether you are a notary public, a mobile signing agent, or a small business owner, the way you accept payments directly impacts your cash flow, client satisfaction, and even your profitability.

Today, there are more ways than ever to accept payments—credit/debit cards, cash, checks, and a wide range of digital processors like Square, PayPal, QuickBooks Payments, Stripe, and even your own bank’s merchant services. But each method comes with pros, cons, and costs that every business owner should understand.

The Importance of Offering Multiple Payment Options

Clients appreciate flexibility. Some prefer the speed of a credit card, while others may only have cash or a check on hand. Offering multiple options:

Builds trust and credibility – You look more professional when you can meet clients where they are.

Improves customer experience – No more lost business because you couldn’t take a preferred form of payment.

Increases likelihood of timely payment – The easier it is for clients to pay, the faster you’ll get paid.

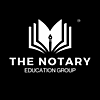

Traditional Payment Methods

Cash 💵

Pros: Instant, no processing fees, universally accepted.

Cons: No paper trail unless you issue receipts, risk of theft or loss, less convenient for remote/online services.

Checks

Pros:

No processing fees when deposited.

Good for larger payments.

Provide a paper trail and proof of payment.

Easier to deposit now with mobile banking apps—no need to visit a branch.

Cons:

Risk of bounced checks, which can lead to returned check fees.

Stop-payment orders cost $15–$30, which makes clients less likely to cancel—but if they do, you lose the funds and may pay a fee.

Slower clearing time (typically 1–3 business days with mobile deposit; longer for new accounts or large checks).

Less convenient for online or last-minute transactions.

Note: If a check bounces, you may face a returned check fee from your bank. Some states allow you to charge the client a fee for insufficient funds, but check your local laws first.

Credit/Debit Cards 💳

Pros: Fast, convenient, secure, and professional. Clients often prefer using cards.

Cons: Processing fees typically range from 2%–4%. Some processors also charge monthly or per-transaction fees.

Popular Payment Processors

Square

Pros: User-friendly, no monthly fee, flat-rate pricing (about 2.6% + 10¢ per transaction), works with mobile readers.

Cons: Funds may take 1–2 days to deposit unless you pay extra for instant transfers.

PayPal

Pros: Widely recognized, easy online invoicing, integrates with websites.

Cons: Higher fees (around 2.9% + 30¢), sometimes delays in releasing funds, and chargebacks can be tricky.

QuickBooks Payments

Pros: Seamlessly integrates with QuickBooks accounting, convenient for bookkeeping and tax reporting.

Cons: Fees similar to Square and PayPal; best for those already using QuickBooks.

Stripe

Pros: Great for online businesses, flexible API integration, competitive fees.

Cons: More tech-heavy setup, not as simple for in-person transactions unless paired with apps.

Zettle (by PayPal)

Pros: Affordable card reader, lower fees (about 2.29% + 9¢), integrates with PayPal.

Cons: Less brand recognition than Square; limited features for complex businesses.

Your Bank’s Merchant Services

Pros: Trusted source, direct link to your business account, sometimes lower fees for existing customers.

Cons: Can have higher setup costs, monthly minimums, and long-term contracts.

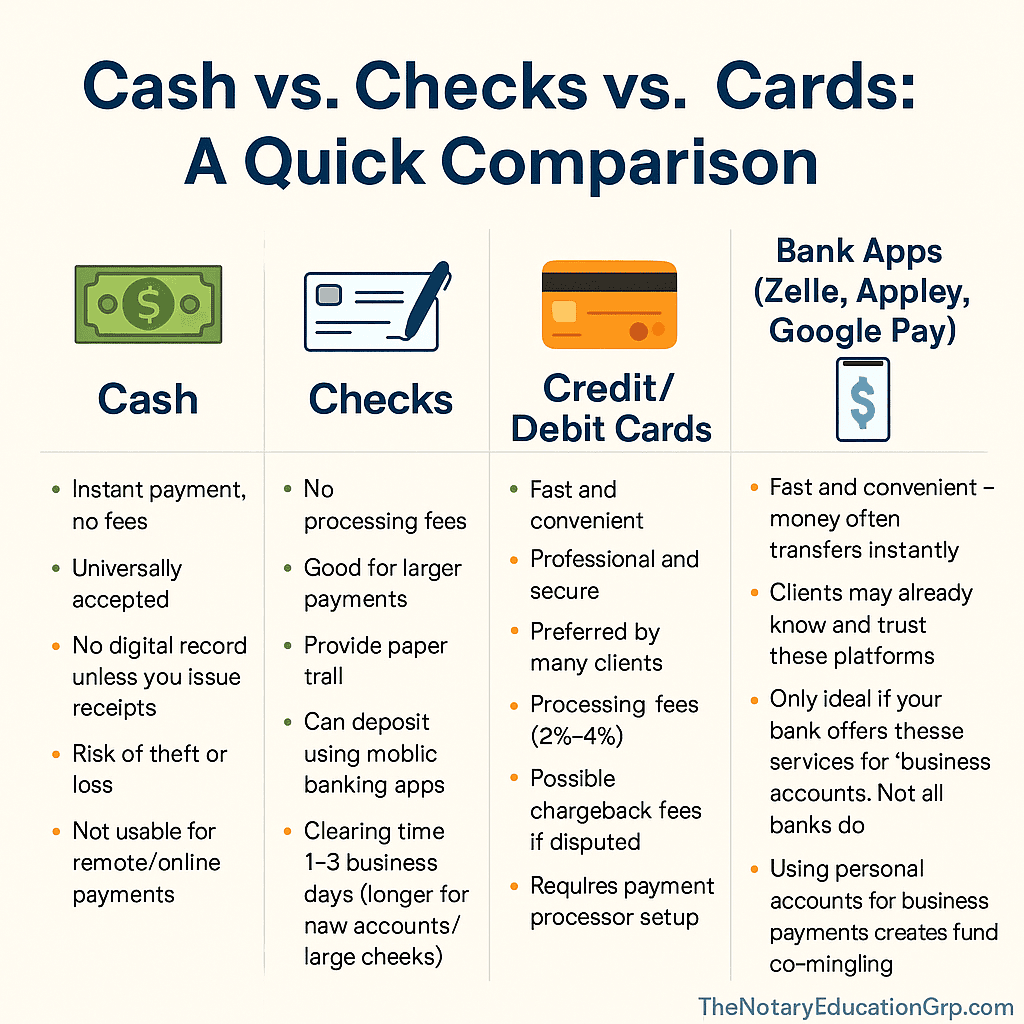

Zelle, Apple Pay, Google Pay (Bank-Linked Services)

Pros:

Fast and convenient—money often transfers instantly.

Clients may already be familiar with and trust these platforms.

No processing fees when used through a business bank account.

Cons:

Only ideal if your bank offers these services for business accounts. Not all banks allow it.

Using a personal account for business payments creates co-mingling of funds, which is not compliant bookkeeping and can cause IRS/tax issues.

Limited tracking and invoicing features compared to full processors like Square or Stripe.

⚠️ Important: Some people accept payments into a personal Zelle/Apple/Google account and then transfer to their business account. This may seem convenient, but it blurs the line between personal and business funds—a practice you should avoid for legal and accounting compliance. Always link these payment methods to your business bank account only.

Best Practices to Optimize Payments

Encourage card or digital payments for speed and record-keeping.

Offer cash/check options for clients who prefer them, but set policies (like requiring ID for checks).

Be transparent about fees. If you pass along processing costs, disclose it clearly.

Choose a processor that fits your business size. For small notary or mobile businesses, Square or Zettle may be best. For growing businesses with heavy invoicing, QuickBooks or Stripe could be better.

Always issue receipts to protect yourself and your clients.

Final Thoughts

As a small business or notary, your payment system should be simple, secure, and flexible. Offering multiple methods ensures you don’t lose clients, while choosing the right processor helps you maximize profits and minimize delays.

Remember: the goal isn’t just to get paid—it’s to get paid on time, with as little friction as possible.