Biometric vs. KBA: What Every Title Agent and Underwriter Should Know

In the evolving world of online notarization, verifying a signer’s identity is more important than ever. As technology advances, two primary methods have emerged as gatekeepers in the digital signing space: Knowledge-Based Authentication (KBA) and Biometric Authentication.

Both serve the same essential purpose—to verify the identity of a signer—but they go about it in very different ways. Understanding the differences between these two methods, their strengths and weaknesses, and why one may be preferred over the other is essential for notaries who want to stay compliant, secure, and ahead of the curve.

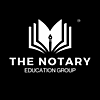

What is Knowledge-Based Authentication (KBA)?

KBA is a form of identity verification that requires a signer to answer a series of personal questions, typically pulled from public records or credit history. These questions may ask about previous addresses, loan amounts, vehicles registered, or even relatives’ names.

Pros of KBA:

Widely Accepted: Currently used by many Remote Online Notarization (RON) platforms.

Quick Implementation: Does not require additional hardware or biometric data.

Familiar to Users: Most signers have encountered this during credit checks or online applications.

Cons of KBA:

Not Foolproof: Friends or family members with enough personal knowledge can potentially pass KBA on behalf of someone else.

Data Dependency: Individuals with little credit history or those who’ve recently moved may not have sufficient data to generate KBA questions.

Privacy Concerns: Answers are based on sensitive personal information that could be compromised.

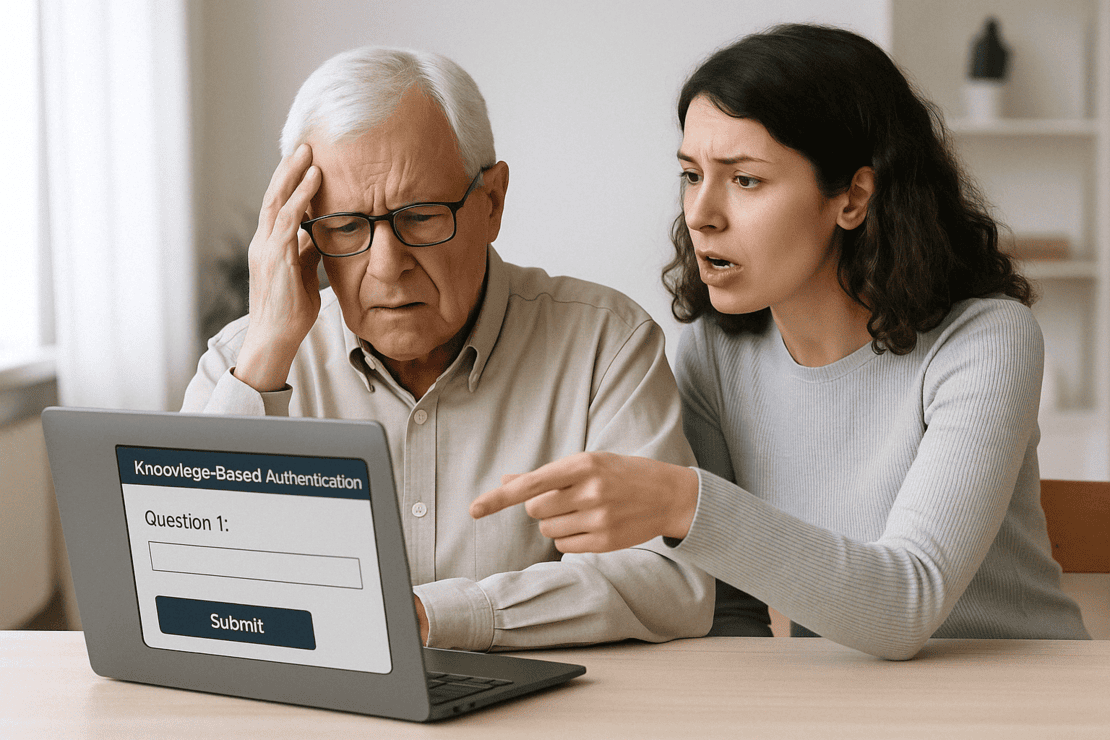

What is Biometric Authentication?

Biometric authentication verifies identity through unique physical characteristics such as facial recognition, fingerprints, or iris scans. In the RON space, facial recognition is the most commonly used biometric method.

Pros of Biometrics:

Highly Secure: Physical traits are unique to each individual and extremely difficult to replicate.

Imposter-Proof: A friend or family member cannot "guess" or fake your face or fingerprint.

Improved Compliance: Biometrics can create a strong audit trail and align with high standards for fraud prevention.

Cons of Biometrics:

Technology Access: Requires a device with a working camera or scanner.

Potential False Rejections: Poor lighting or camera quality may cause issues during facial scans.

Privacy & Data Storage: Raises concerns about where biometric data is stored and how it's protected.

Why Biometrics are Emerging as the Preferred Standard

While KBA is still accepted by most online notary platforms, the reality is that it can be manipulated. A friend or relative with knowledge of the signer’s personal history can potentially pass the test and impersonate the signer, opening the door to fraud.

Biometric authentication, on the other hand, offers a level of identity assurance that cannot be duplicated or easily bypassed. A face is a face. A fingerprint is a fingerprint. Biometrics provides an extra layer of confidence not just for notaries—but also for signers, clients, and regulatory bodies alike.

As online notarization grows and regulations tighten, we can expect to see biometric authentication become the gold standard. Notaries who adopt this technology early on will be ahead of the curve and better equipped to protect the integrity of their signings.

State Laws Matter: KBA vs. Biometrics is Not Always a Choice

While biometric authentication may offer superior security and user confidence, it’s important to understand that not every state permits bypassing KBA in Remote Online Notarizations. Some states mandate that KBA must be used—either exclusively or in combination with biometric verification—regardless of advancements in technology.

However, Florida stands apart. Under Florida's online notary statutes, commissioned online notaries are permitted to use biometric authentication without requiring KBA, provided the identity verification system meets state-approved standards. This gives Florida notaries greater flexibility to offer a more secure, user-friendly signing experience—especially for elderly or high-risk clients.

So, when your title company, lending institution, or legal team prefers to use biometric verification and avoid the complications of KBA, connect with a Florida Online Notary. We're legally authorized, technologically equipped, and happy to assist you and your signers with streamlined, secure remote closings.

Final Thoughts from the FL Online Notary’s Desk

As a Florida-based Notary Public and CEO, I believe that while KBA has served us well, the future lies in biometric technology. We must continue to embrace innovation that puts security and trust at the forefront of our profession. Your signer’s identity isn’t just a formality—it’s the foundation of everything we do.

Let’s protect it accordingly.

Need a Notary That Uses Biometrics? Choose Florida.

At B. Elise Notary Services LLC, we proudly serve clients nationwide as a Florida-authorized online notary, offering advanced biometric authentication options without requiring outdated KBA methods.

🎯 Secure. Compliant. Efficient.

Whether you're a title company, loan officer, legal team, or private client, we ensure every signer is verified with confidence.

📩 Ready to schedule?

Visit www.belisenotary.com or contact us today to experience notarization—the Florida way.