Understanding When to Use a Driver License, State ID, Passport, or Social Security Card

When asked for identification, many people instinctively reach for their passport. It feels official, powerful, and universally accepted. But as a notary and educator, I can tell you this with certainty:

Using your passport instead of your driver license or state ID is not always a good idea.

In many cases, it’s unnecessary—and sometimes risky.

Understanding the purpose of each form of identification is essential to protecting your identity and avoiding unnecessary exposure of sensitive personal information.

Not All Identification Documents Serve the Same Purpose

One of the most common misconceptions I see is the belief that all government-issued IDs are interchangeable. They are not.

Driver licenses and state IDs are primarily used to confirm identity

Passports and Social Security cards are used to verify citizenship or eligibility

Each document serves a distinct role depending on the nature of the transaction.

Why a Passport Is a High-Value Document

A passport is just as important—and just as sensitive—as a Social Security card.

Your passport:

Proves U.S. citizenship

Can be used to obtain other government documents

Can expose you to identity theft if lost or misused

Unlike a driver license, a passport is not easily replaced, and misuse can have long-term consequences.

Not Everyone Can Obtain a Passport or Social Security Card

Another important fact many people overlook is that not everyone qualifies for these documents.

A person may be denied a U.S. passport due to:

Significant child support arrears

Certain federal tax delinquencies

Outstanding warrants or court restrictions

Inability to verify citizenship documentation

A person may be denied a Social Security number or replacement card due to:

Immigration or authorization status

Inconsistent or unverifiable birth records

Prior fraud or misuse connected to their information

These documents are privileges tied to eligibility—not guaranteed rights.

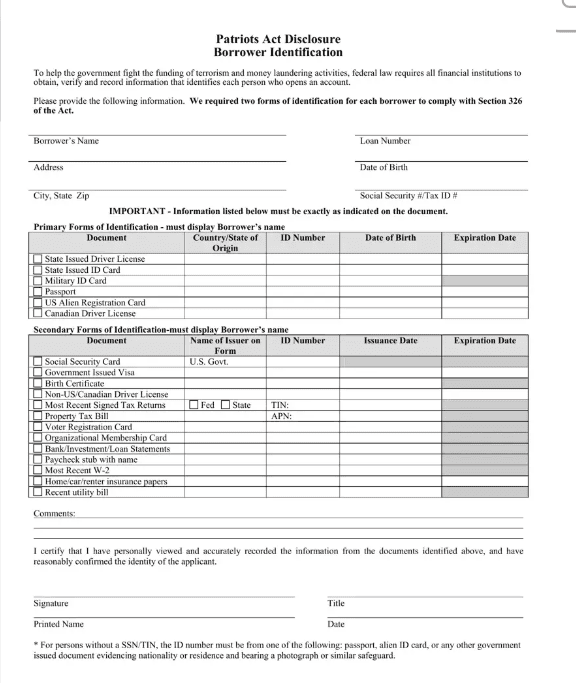

How the Patriot Act Borrower Identification Form Applies in Real Transactions

I want to take this a step further by tying this conversation to a document many people have seen—but may not fully understand—the Patriot Act Borrower Identification Form.

This form exists to comply with Section 326 of the USA PATRIOT Act, which requires financial institutions to verify the identity of each person involved in certain financial transactions, particularly borrowers.

To meet this requirement, the form shown above clearly states that two forms of identification are required—not optional.

Why Two Forms of ID Are Required on This Form

The purpose of requiring two forms of identification is layered:

One form confirms identity

The second supports citizenship, residency, or eligibility

Together, they reduce fraud, impersonation, and financial crime

This is not about convenience—it is about federal compliance.

Accepted Forms of Identification (Based on the Patriot Act Form)

Using the Patriot Act form above as reference, here is how identification is typically categorized:

Primary Forms of Identification

(Used to confirm who you are and must display the borrower’s name)

State-issued driver license

State-issued identification card

Military ID card

U.S. passport

U.S. alien registration card

Canadian driver license

These documents usually include a photograph, date of birth, and identifying number.

Secondary Forms of Identification

(Used to support citizenship, residency, or financial legitimacy)

Social Security card

Government-issued visa

Birth certificate

Non-U.S./Canadian driver license

Most recent signed tax returns

Property tax bill

Voter registration card

Organizational membership card

Bank or investment loan statements

Paycheck stub with name

Most recent W-2

Homeowner or renter insurance papers

Recent utility bill

Notably, many of these do not contain a photo, which is why they are used as supporting documents rather than primary identification.

Transactions Where This Form Commonly Applies

Based on my experience, Patriot Act identification requirements often apply to transactions such as:

Mortgage loans and refinances

Real estate purchases involving financing

Opening or modifying bank accounts

Investment or brokerage accounts

Certain insurance or annuity products

Financial transactions involving large sums

In these situations, the request for two forms of ID is driven by federal law, not preference.

Why This Reinforces the Importance of Using the Right ID

Here’s the key connection I want people to understand:

A driver license or state ID is usually best for identity confirmation

A passport or Social Security card is used for citizenship or eligibility verification

These documents serve different purposes, even when used together

That is also why I caution against voluntarily presenting a passport or Social Security card unless the transaction explicitly requires it.

These are high-risk documents. Once copied, scanned, or mishandled, the exposure cannot be undone.

Always Know What You’re Being Asked—and Why

Before completing a transaction:

Ask if the request is tied to Patriot Act compliance

Confirm which documents are required, not just accepted

Provide only what applies to the specific transaction

As a notary, my role is not only to verify identity—but to encourage awareness. Knowing the difference between identity verification and citizenship verification helps protect you long after the paperwork is signed.

Know the requirement. Know the purpose. And never overshare your identity.

Do Not Voluntarily Present Sensitive Documents

This cannot be overstated:

You should never voluntarily present your passport or Social Security card unless it is absolutely required.

The requirement depends on:

The specific transaction

Applicable laws or regulations

The nature of the service being performed

Just because someone requests it does not mean it is legally necessary.