Why Ink Color Matters in Document Signing: Not Just Black and White

Introduction

When you pick up a pen to sign a document, you might think the ink color doesn’t matter—as long as your signature is there. But in the world of legal, financial, and real estate transactions, ink color is more than just a personal choice. It’s about clarity, compliance, and sometimes even fraud prevention.

So why do certain industries require blue ink, while others insist on black? Let’s dive in.

1. The Purpose of Specifying Ink Colors

Ink color requirements exist to:

Differentiate originals from copies: A blue-ink signature makes it easier to spot the original document among black-and-white photocopies.

Ensure authenticity: Some lenders, title companies, or government agencies want a quick visual check that the signature is not a reproduction.

Meet archival standards: Black ink is often required for documents that will be scanned or stored long-term, because it reproduces more clearly than lighter inks.

2. Common Ink Color Rules in Transactions

✒️ Blue Ink

Preferred in real estate closings and many financial transactions.

Makes it simple to distinguish originals from copies.

Many lenders require blue for loan documents.

✒️ Black Ink

Standard for government forms, court filings, and notarial certificates.

Scans and photocopies clearly, which is essential for long-term storage.

Required by many state agencies for consistency.

✒️ Other Colors (Red, Green, etc.)

Rarely accepted in legal transactions.

May fade over time or not reproduce well in copies/scans.

Sometimes used internally for editing, but not valid for signing official documents.

3. Why Not Just Use Black Ink for Everything?

On the surface, black ink seems like the universal solution. But here’s why it’s not always ideal:

Visual distinction matters: When hundreds of pages are signed, a blue signature instantly tells the reviewer it’s an original.

Fraud prevention: Blue ink helps reduce the risk of someone passing off a photocopy as an original signed document.

Client instructions: Failing to follow lender, title company, or agency specifications can cause funding delays, rejected filings, or the need to re-sign documents.

4. What This Means for Notaries and Signers

Always confirm requirements: Some companies specify ink color in their closing instructions or signing guidelines.

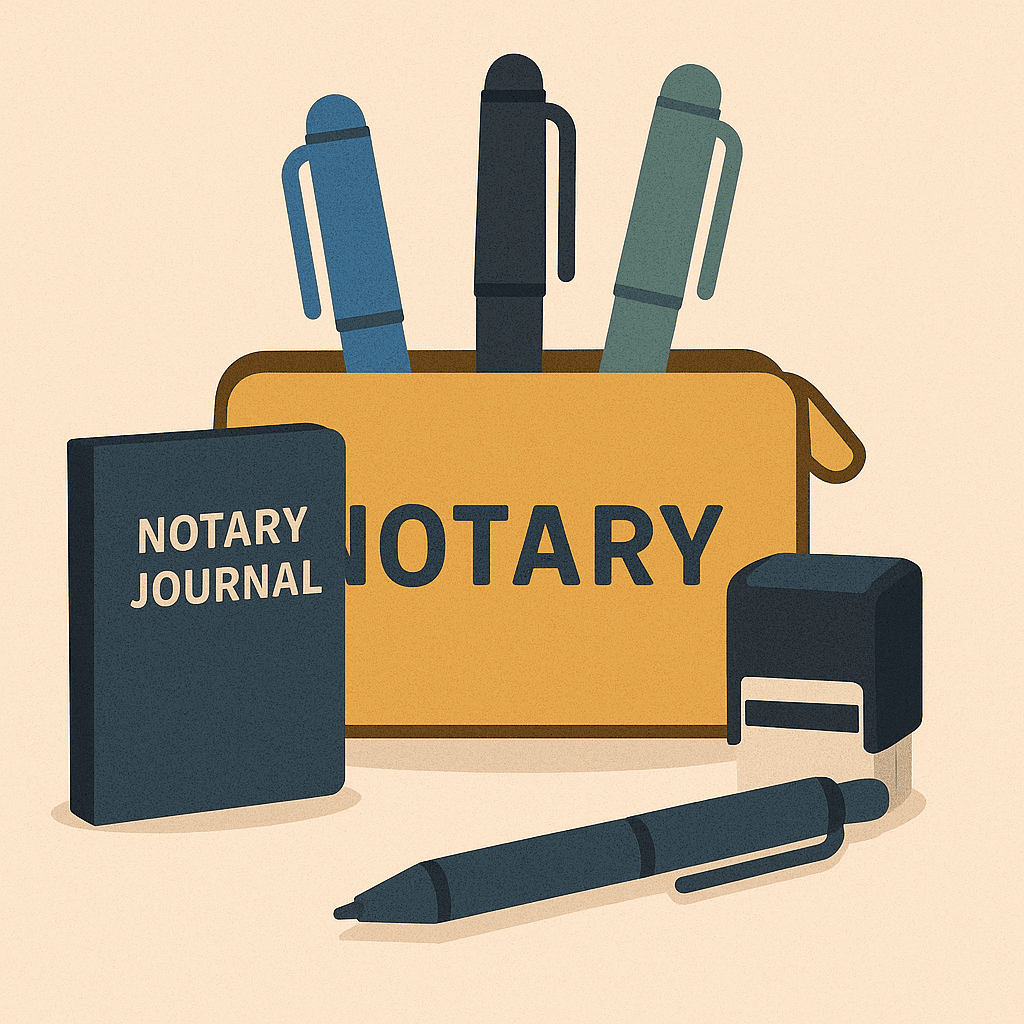

Keep multiple pens on hand: A professional notary carries both black and blue ink to meet client needs.

Educate signers: If a client questions why they can’t use their favorite pen, explain that the wrong ink could cause the document to be rejected.

5. Best Practices

Default to blue ink unless specifically instructed otherwise for real estate and financial closings.

Use black ink for government, court, or notarial certificates unless told differently.

Avoid gel pens or non-traditional colors, which may smudge, fade, or scan poorly.

Document in your notary journal what ink was used if it’s a special requirement.

Conclusion

Ink color may seem like a small detail, but in legal transactions, small details carry big weight. Choosing the correct ink color helps preserve authenticity, prevents rejections, and keeps transactions running smoothly.

✅ Blue ink = distinguish originals.

✅ Black ink = archival clarity.

✅ Other colors = not for official use.

Next time you pick up a pen at a signing, remember: the color matters more than you think.

💡 Want more insights into the notary world and professional signing practices? Visit thenotaryeducationgrp.com for resources, training, and updates.